How Can Insurance Companies Benefit from Remote Workforces?

The recent epidemic saw millions of companies globally switch to teleworking. Once the virus is curbed, experts predict that the trend will remain. According to The Guardian, millions of people will get the chance to experience days without long commutes or harsh inflexibility – which could be a great reset in how we approach work.

Many businesses are likely to become less reluctant to outsource talent, and insurance companies are no exception, as their business models allow them to reap the benefits of remote work and distributed teams. Let’s see what the key benefits are:

Reduce Your Costs

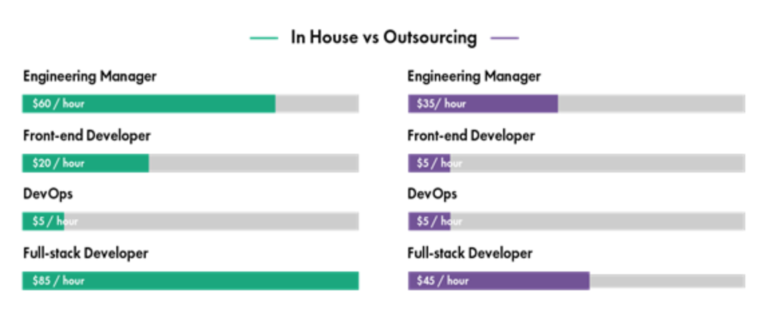

High demand for qualified technical personnel, especially with domain knowledge, naturally complicates the hiring process for insurance companies. The costs of acquiring and onboarding in-house employees are relatively high. Outsourcing, however, is one viable option to save costs.

Any insurance agency could outsource a specific technical discipline, like business analysis, quality assurance, DevOps, or an entire development team to leverage financial resources in favor of development quality.

Denis Baranov, Principal Consultant at DataArt, comments on the benefits of remote workforces:

“At DataArt, we’ve operated in a mostly distributed culture from the very beginning. We understand how tricky and fourth-rate it can be. However, we have passed this way many times with our clients, and know the tricks of the trade.”

Even if you do have one team member working remotely, this indicates that the whole team is already distributed. This means, in the initial stages of remote work set-up, some extra efforts are required to organize means of communication, schedule regular calls, and plan feedback sessions. However, setting this framework up is a one time task: you do it once, and it works for years. It is, in fact, another way to optimize corporate spending.

Find Your Niche Expert Quickly

Insurance, like any other industry, requires personnel to be savvy in specific domain practices and standards. This means that recruiting a niche in-house specialist becomes almost an unsolvable issue for many insurance companies. It could take months, or longer, to find a person with the required set of skills, especially on a per-project basis.

DataArt InsurTech expert, Peter Rakowsky explains:

“Finding a developer to work on a software project is the easy part. Finding a developer who knows the insurance industry is tricky. This is where DataArt excels, as many of our engineers have worked on projects within insurance.”

To get access to a pool of software engineers with strong domain knowledge, your insurance company could partner with an IT solutions provider. Solid IT companies usually keep a number of specialists on the bench, which allows them to quickly staff new projects or scale teams up within just a couple of business days.

Conclusion

Our new reality brings more and more opportunities for insurance companies. Empowered by remote personnel, carriers around the globe can now obtain a competitive advantage. To feel the advantages of distributed teams, it’s important to find a reliable technical partner. Find someone who will advise you on the best approach for remote working unique to your operating model and business needs.

Peter Rakowsky

Global Innovation Manager, DataArt

peter.rakowsky@dataart.com

Denis Baranov

Principal Consultant, DataArt

denis.baranov@dataart.com

WANT TO SHARE YOUR KNOWLEDGE?

With world’s largest forum for insurance professionals, Insurtech Insights provides an invaluable platform for networking, new insights and exposure for thought leaders. We are always looking for new partners, content creators, and contributors to create value and deliver exceptional support to Insurtech Insights.

To share your knowledge, simply fill out the form.

Bradley Collins

- bradley.collins@insurtechinsights.com

- +44 7928 474427